by Leroy Prince | Aug 23, 2023 | Regulation

Key Points

- Bankrupt crypto lender BlockFi is working on blocking FTX and 3AC from retrieving millions in loan payback.

- FTX and 3AC had lent money to BlockFi but underwent bankruptcy in 2022, necessitating the payback of loans given to the crypto lender.

In an August 21 filing in a New Jersey Bankruptcy Court, BlockFi claimed that its creditors should not be pushed as FTX’s creditors were harmed by the exchange’s misappropriation of $5 billion that BlockFi had lent it. It also added that bankrupt crypto hedge fund 3AC committed fraud with the money lent and thus should not be entitled to a potential repayment.

BlockFi tries to block 3AC and FTX from retrieving millions in payback

BlockFi, FTX, and 3AC were some of the largest crypto fraud and bankruptcy cases ever seen in the industry’s history. They “coincidentally” happened in the same year and conspicuously had ties to each other.

As such, there have been multiple tussles between these organizations as they try to repay their dues to creditors and refund users’ money simultaneously. BlockFi, a bankrupt crypto lender, has been pushing for long that FTX and 3AC not get paid from its liquidations as they may have misappropriated the money it lent.

Estimates show that BlockFi owes around $ 10 billion to over 100K creditors and $! Billion to three of its largest ones. In the mix of freditors comes 3AC and FTX. It owes 3AC about $220 million and FTX around $400 million. FTX and 3AC have been pushing to get these hundreds of millions back as they would make it much easier to repay their creditors.

However, a recent Court filing shows that BlockFi feels the two creditors are the real victims in the case. An excerpt from the filing reads:

“FTX seeks to recover on over $5 billion of claims filed against the BlockFi estates at the direct expense of the ultimate victims of FTX’s fraud: BlockFi’s clients and other legitimate creditors.”

“To prevent further injustice to the creditors of BlockFi’s estates, the Court should disallow the FTX claims under the doctrine of unclean hands,” BlockFi added.

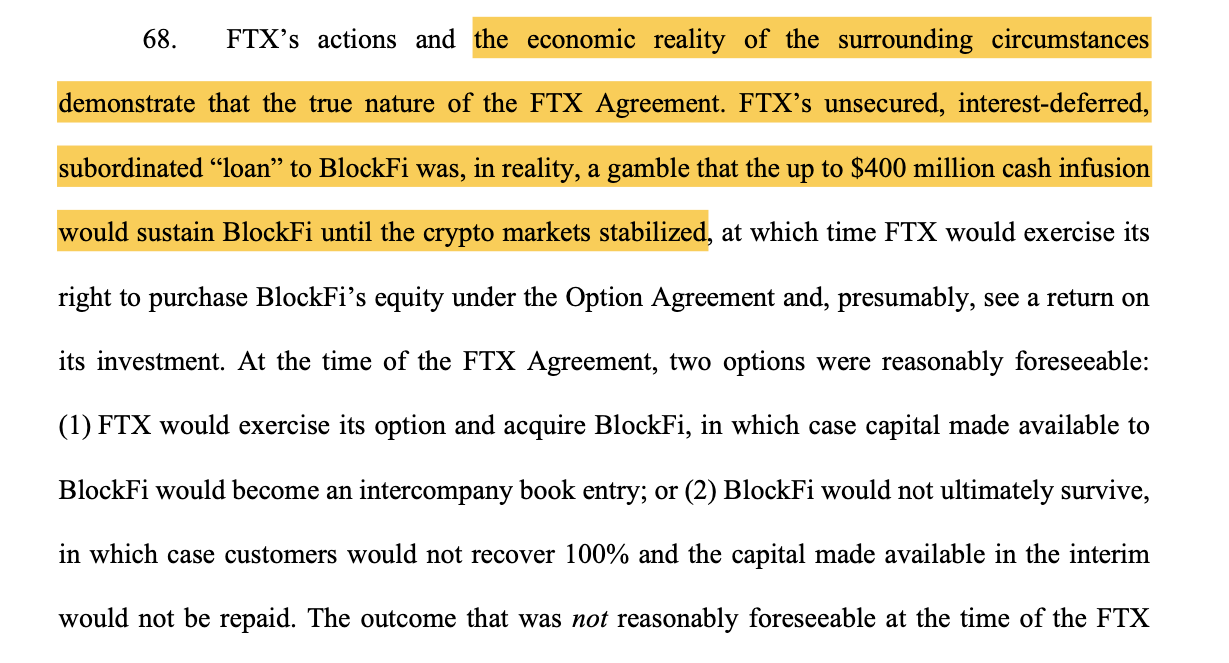

BlockFi further indicates that the $400 million FTX gave wasn’t a standard loan as it was under an agreement to have a five-year term that would not activate until the firm supposedly matures. As such, BlockFi feels that it should be treated as a “gamble” for which it should not be liable.

Despite the ongoing skirmishes, creditors recently settled with BlockFi in July to proceed with the set repayment plan. However, it is still yet to be seen if it will work out as 3AC and FTX’s $1 billion loans would significantly affect its creditors’ payout. Keep watching Fintech Express for updates on this and other fintech-related developments.

by Melissa Adams | Aug 23, 2023 | Regulation

Key Points

- Binance.US has scored another win after securing a partnership with MoonPay after having its US bank ties severed.

- The exchange was on the spot after a lawsuit from the US SEC, prompting the banks to draw away from it as preventive measures.

Binance.US has scored another win after partnering with MoonPay to restore USD deposits and withdraws. The platform had lost its USD ramps due to the US SEC lawsuit.

Relief for Binance.US as it lands a new banking ramp

Binance.US had abandoned its USD banking partners after the US SEC pressed charges against it. As a result, it was forced to suspend all USD withdraws and deposits; however, customers could still switch their USD balances to other currencies and withdraw them.

The platform is now operating as a crypto-only trading exchange despite being on a legal tuff with regulators in the country. It has announced a new partnership with MoonPay to allow its users to buy USD-pegged Tether USDT stablecoin that can be used on its platform for trading purposes.

It announced on August 22 that USDT is selected as the base asset for all transactions between it and MoonPay, creating a path for trading using USD.

by Leroy Prince | Aug 18, 2023 | Regulation

Key Points

- Defunct crypto lender Celsius is set to allow its creditors to vote for the sale to Fahrenheit Consortium following a Thursday approval from a judge.

- Celsius Creditors will be able to recover 67% to 85% of the company’s holdings if the sale goes through

Celsius creditors have been given a legal green light to hold a vote on whether to sell to Fahrenheit Consortium, a process that could see them recover 67 to 85% of their holdings.

Celsius creditors to vote on the plan to escape bankruptcy

Celsius network bankruptcy was filed in 2022 as the company could not meet its operational budget, and user money had been spent. As an aftermath, a court proceeding has been going on to ensure a smooth company transition as several interested buyers have shown up.

Celsius Network ex-CEO Alex Mashinsky has been arrested for fraud and is under US investigations. However, all is not lost for the company’s creditors. On August 17, a judge gave a legal green light for a vote to be held regarding the sale of the crypto lender.

This development is a final step for the year-long awaited solution of bankruptcy protection legal proceedings and the return of funds to customers. The interim CEO of the company, Chris Ferraro, said that they now remain focused on creating the best outcomes for both customers and creditors.

“We remain laser-focused on creating the best outcome for customers and creditors and returning value as soon as possible.”

Keep watching Fintech Express for more updates on this and other fintech-related developments.

by Chelsea Florence | Aug 17, 2023 | Regulation

Key points

- Ripple vs. SEC case has been going on for years but has taken a dramatic turn as the US SEC recently lost partially.

- The Presiding Judge ruled that the sale of XRP in primary and programmatic markets does not constitute the factors that could deem it a security.

- Now, Ripple Labs Chief Legal Officer has hit back at the US SEC for filing a request for an appeal against the US SEC, saying there currently are no “extraordinary circumstances” in the case that warrants an interlocutory appeal at this stage.

Ripple Labs’ chief legal officer has hit back at the US SEC, expressing that no “extraordinary circumstance” warrants the US SEC’s ability to appeal the partial loss while the case is still pending.

Ripple Labs legal counsel not convinced by US SEC appeal.

Ripple Labs Chief Legal Officer Stuart Alderoty has hit back at the US SEC move towards filing for an interlocutory appeal relating to their July 13 XRP case partial loss laid down by U.S. District Court Judge Analisa Torres.

In an August 16 letter, Judge Torres explained that XRP failed to pass Howey’s tests in primary or programmatic markets, which makes it not a security. She explained that the court should reject the SEC’s motion for leave to file an interlocutory appeal. An interlocutory appeal occurs when a ruling by a court gets appealed as other aspects of the case are still underway.

Now, Ripple Labs’ legal system believes it is more appropriate for the US SEC to wait until the final ruling before filing for an appeal. The lawyers explained three main arguments starting with that the appeal needs the US SEC to raise new legal issues, which has yet to be the case.

Secondly, they claim that the US SEC that the court ruled incorrectly on the matter could be more efficient since it has to show that at least two courts are in apparent conflict with each other, which is not the case here. Thirdly, they explained that an immediate appeal would not advance the termination litigation proceedings.

Ripple Labs Chief Legal Officer Stuart Alderoty explained that the US SEC doe not have any extraordinary circumstance that would justify departing from the normal legal procedure.

“No extraordinary circumstance here would justify departing from the rule requiring all issues as to all parties to be resolved before an appeal.”

This case is expected to continue with the US SEC not giving up quickly, as it sets a significant precedent for all other cases connected to certain crypto assets being securities. By now, the US SEC has branded over 62 crypto assets as securities and charged multiple exchanges for trading them in the US.

As such, the case will be a landmarking event in the crypto industry as it will change the regulatory approach of the industry in the US forever. Keep watching Fintech Express for more updates on crypto regulation and other fintech-related developments.

by Joseph Reagan | Aug 15, 2023 | Regulation

Key points

- The Monetary Authority of Singapore, in conjunction with the Central Bank of Singapore, has released a new regulatory framework for stablecoins.

- The new framework requires stablecoin issuers to be regulated by the Monetary Authority of Singapore for their assets to be used there.

The Central Bank of Singapore has introduced a new crypto regulatory framework targeting the stablecoin industry. The new framework requires stablecoin issuers to register with the MAS.

Central Bank of Singapore continues to increase oversight of crypto regulation

The Central Bank of Singapore released a revised regulatory framework that aims at ensuring stability for single-currency stablecoins (SCS) regulated in the state.

The MAS announced the new framework on August 15, which aims at streamlining the use of the Singaporean dollar or the G10 pegged currencies like Euro, USD and the British pound. The target assets should also have exceeded 5 million Singaporean dollars in circulation ($3.7 million).

Central Bank of Singapore supervision deputy managing director Ho Hern Shin, said the framework is set to facilitate stablecoin use as a “credible digital medium of exchange” and as a “bridge” between fiat and digital assets. Shin encouraged stablecoin issuers to be ready to comply with the new regulatory framework if they wanted to be branded as MAS-regulated entities.

The MAS has been proactive in regulating and adopting crypto assets for a long time. It recently pulled joint efforts with the UK FCA and has also committed $150 million in fintech markets, aiming to welcome more users in Web 3. While the new stablecoin framework has already been announced, the MAS needs to have the parliament pass it into law to enforce it.

Keep watching Fintech Express for updates on regulations and other fintech-related developments.

by Chelsea Florence | Aug 10, 2023 | Regulation

Key Points

- France has updated its crypto licensing rules to match MiCa legislation

- The new amendments will come into effect on January 1, 2024, around the same time as the MiCA legislation

Applicants for DASP regulatory licenses in France starting in the year 2024 will have to follow MiCA legislation as the country has updated its licensing regime. The Eurozone is expected to enforce MiCA regulation in 2024, ushering in a new era of regulated blockchain and crypto adoption.

France ramps up crypto licensing rules to match MiCA

A press release from Autorité des Marchés Financiers (AMF), France’s main financial authority ushers in new policies that will see digital asset service providers take an “enhanced” registration process to comply with crypto licensing rules to match MiCA legislation.

The new registration requirements are captured by the AUMF’s article 721-1-2 of the MAF General Regulation that will include systems for managing conflict of interests, more disclosure obligations, and prohibition to use client assets without their consent, among others.

While these regulations were set in on January 1, 2024, any crypto exchange licensed before the new amendments will benefit from much lighter requirements set, which is protected by a “Grandfather clause” that comes as a simpler version of the MiCA regulatory framework.

Keep watching Fintech Express for more updates on this and other fintech-related developments.