by Leroy Prince | Aug 23, 2023 | Regulation

Key Points

- Bankrupt crypto lender BlockFi is working on blocking FTX and 3AC from retrieving millions in loan payback.

- FTX and 3AC had lent money to BlockFi but underwent bankruptcy in 2022, necessitating the payback of loans given to the crypto lender.

In an August 21 filing in a New Jersey Bankruptcy Court, BlockFi claimed that its creditors should not be pushed as FTX’s creditors were harmed by the exchange’s misappropriation of $5 billion that BlockFi had lent it. It also added that bankrupt crypto hedge fund 3AC committed fraud with the money lent and thus should not be entitled to a potential repayment.

BlockFi tries to block 3AC and FTX from retrieving millions in payback

BlockFi, FTX, and 3AC were some of the largest crypto fraud and bankruptcy cases ever seen in the industry’s history. They “coincidentally” happened in the same year and conspicuously had ties to each other.

As such, there have been multiple tussles between these organizations as they try to repay their dues to creditors and refund users’ money simultaneously. BlockFi, a bankrupt crypto lender, has been pushing for long that FTX and 3AC not get paid from its liquidations as they may have misappropriated the money it lent.

Estimates show that BlockFi owes around $ 10 billion to over 100K creditors and $! Billion to three of its largest ones. In the mix of freditors comes 3AC and FTX. It owes 3AC about $220 million and FTX around $400 million. FTX and 3AC have been pushing to get these hundreds of millions back as they would make it much easier to repay their creditors.

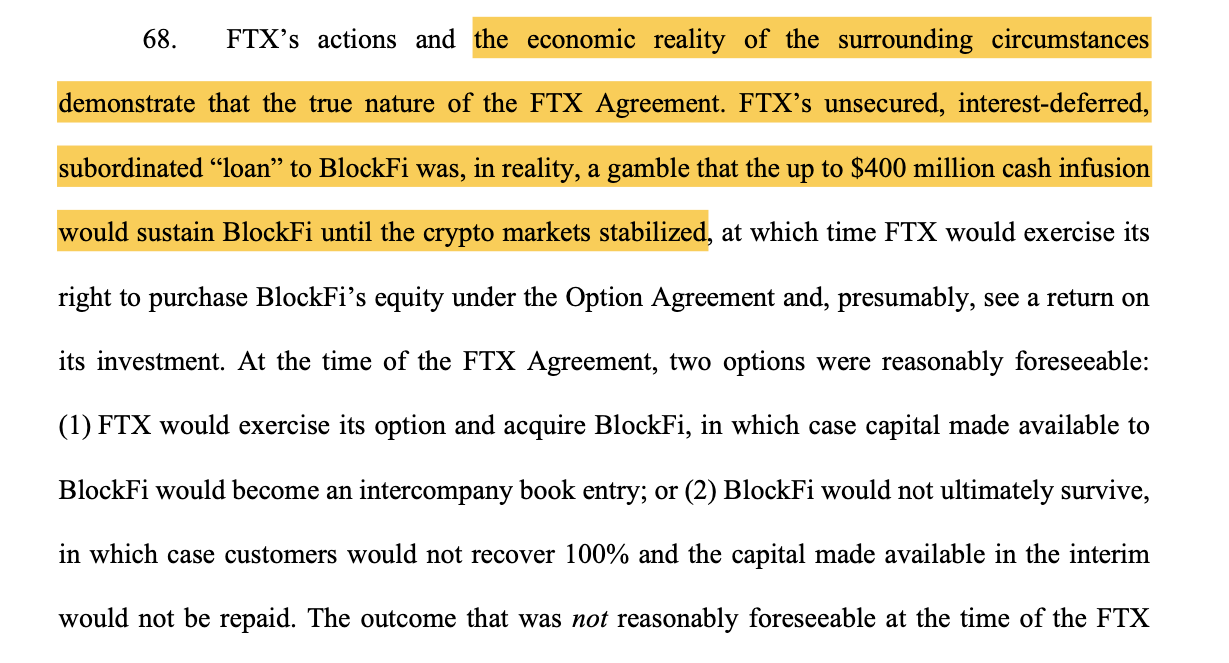

However, a recent Court filing shows that BlockFi feels the two creditors are the real victims in the case. An excerpt from the filing reads:

“FTX seeks to recover on over $5 billion of claims filed against the BlockFi estates at the direct expense of the ultimate victims of FTX’s fraud: BlockFi’s clients and other legitimate creditors.”

“To prevent further injustice to the creditors of BlockFi’s estates, the Court should disallow the FTX claims under the doctrine of unclean hands,” BlockFi added.

BlockFi further indicates that the $400 million FTX gave wasn’t a standard loan as it was under an agreement to have a five-year term that would not activate until the firm supposedly matures. As such, BlockFi feels that it should be treated as a “gamble” for which it should not be liable.

Despite the ongoing skirmishes, creditors recently settled with BlockFi in July to proceed with the set repayment plan. However, it is still yet to be seen if it will work out as 3AC and FTX’s $1 billion loans would significantly affect its creditors’ payout. Keep watching Fintech Express for updates on this and other fintech-related developments.

by Leroy Prince | Aug 22, 2023 | Cryptocurrencies

Key Points

- Authorities in the South Korean City of Cheongju are set to seize crypto from uncooperative taxpayers.

- These authorities seek to seize crypto from thousands who have over $750 in crypto taxes to the government.

The South Korean City of Cheongju is set to seize crypto holdings from thousands of taxpayers who owe the government more than $750 in crypto taxes.

South Korean City of Cheongju doubles down on tax evasion among crypto enthusiasts

The City serves as the capital of the North Chungcheong province. Its authorities have indicated they intend to enforce a compliance norm among crypto users.

As such, it has requested seven South Korean crypto exchanges to inquire into the holdings of thousands of tax evaders, as a local news source reported on August 22. These authorities seek assistance from exchanges like Bithumb and Upbit to inquire into over 8K crypto users who owe over $750 each.

Following the inquiry, the administrators seek to repossess the crypto assets as they feel it has been a growing culture that citizens of the country are using crypto to evade tax payments. This process is set to enforce a culture of compliance among all citizens of the nations and block loopholes in tax losses.

It is not the first time South Korea has conducted tax-related crypto confiscations. In 2022 and 2021, the national government collected over $180 million worth of crypto assets from tax evaders.

Keep watching Fintech Express for more updates on crypto and other fintech-related developments.

by Leroy Prince | Aug 18, 2023 | Regulation

Key Points

- Defunct crypto lender Celsius is set to allow its creditors to vote for the sale to Fahrenheit Consortium following a Thursday approval from a judge.

- Celsius Creditors will be able to recover 67% to 85% of the company’s holdings if the sale goes through

Celsius creditors have been given a legal green light to hold a vote on whether to sell to Fahrenheit Consortium, a process that could see them recover 67 to 85% of their holdings.

Celsius creditors to vote on the plan to escape bankruptcy

Celsius network bankruptcy was filed in 2022 as the company could not meet its operational budget, and user money had been spent. As an aftermath, a court proceeding has been going on to ensure a smooth company transition as several interested buyers have shown up.

Celsius Network ex-CEO Alex Mashinsky has been arrested for fraud and is under US investigations. However, all is not lost for the company’s creditors. On August 17, a judge gave a legal green light for a vote to be held regarding the sale of the crypto lender.

This development is a final step for the year-long awaited solution of bankruptcy protection legal proceedings and the return of funds to customers. The interim CEO of the company, Chris Ferraro, said that they now remain focused on creating the best outcomes for both customers and creditors.

“We remain laser-focused on creating the best outcome for customers and creditors and returning value as soon as possible.”

Keep watching Fintech Express for more updates on this and other fintech-related developments.

by Leroy Prince | Aug 1, 2023 | Markets

Key Points

- Oil major BP has reported a drop of nearly 70% YoY in the second quarter of 2023

- At the same time, the British energy major posted a second-quarter underlying replacement cost profit of $2.6 billion

On Tuesday, Oil major BP announced that it was expecting a nearly 70 % drop in its Q2 profits year on year due to the weakening of fossil fuel prices, a trend observed across the industry.

Oil major BP announces 70% drop in profits in Q2 2023 YoY

Analysts now expect Oil major BP to report a second-quarter profit of around $3.5 billion per a report by Refinitiv. At the same time, the British energy major posted a Q2 underlying replacement cost profit (used as a proxy for net profit) of $2.6 billion.

The company’s report comes short of the Q2 profits of 2023, which had been recorded to be $4.96 billion, and the $8.5 billion in profits for the same company from Q2 2022. The company explained that the orbits were impacted by significantly lower realized refining margins, a higher level of turnaround and maintenance activities, and lower oil prices in the markets.

Nonetheless, the company has boosted its dividend by 10% to 7.27 cents per ordinary share for Q2 and said it would repurchase $1.5 billion of its shares spread over Q3 2023. This report is not a unicorn; other companies have struggled to match the bumper profits recorded in the same period in 2022.

Shell and Totalenergies reported a steep drop in Q2 2023 YoY profits last Thursday. In the US, Exxon Mobil also had a slump of 56% YoY in Q2 2023 profits. Keep watching Fintech Express for more updates on oil markets and other fintech-related developments.