The cryptocurrency market continues to be in no man’s land after the sudden selloff early this week with BTC hovering below the short-term daily range since Monday.

Economic data, FOMC

The week ahead is packed with economic data coming from the leading economies. The risk assets markets like stocks and crypto, as always, are looking forward to the Federal Open Market Committee (FOMC) meeting today with the greatest anticipation.

The leading analysts expect the Federal funding rate to be further increased by 25 bps to 5.5 percent. The crypto market by default trades in range prior to FOMC meetings then turns volatile in the minutes before and after the event.

A more hawkish stance from the Committee and a hike above 25 basis points will most probably result in a short-term selloff.

On July 27 we have Main Refinancing Rate decision from the European Central bank and Unemployment Claims in the United States. The EUR rate is expected to rise by 25bps to 4.25 percent while the US market participants will be looking at a potential jump in the Unemployment Claims to 234k.

Finally, on Friday we expect to hear the Bank of Japan Economic Outlook report + Monetary Policy Statement from the Asian country.

US Markets, SPX, DXY

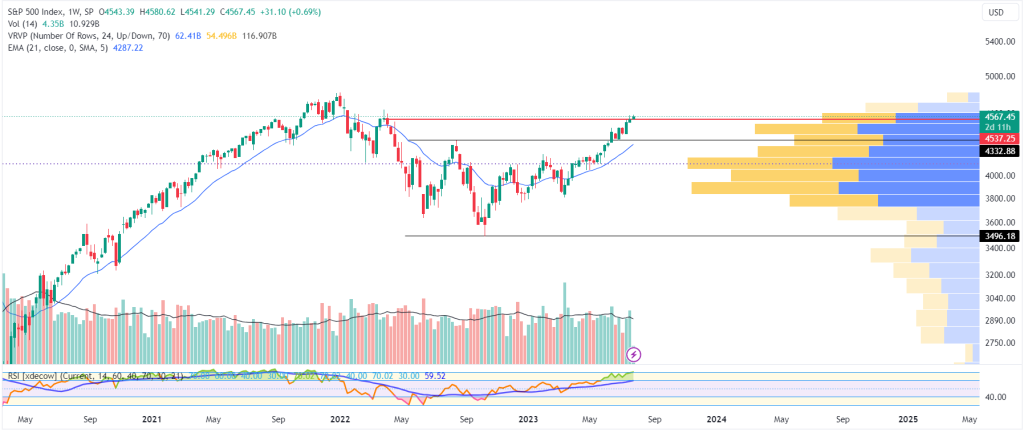

Looking at the already overextended bullish rally in the US stock market, the majority of the analysts are already pointing to some kind of a pullback, at least in the form of a consolidation that will server as a basis to form a new higher low on the weekly chart.

The SPX continues to be in a resistance area above $4,550 and with an extremely overbought Relative Strenght Index (RSI).

As always, the main driver here is the continuing decrease of the US dollar index DXY. The traditional safe haven asset is losing ground, which further pushes the stock market up as investors are searching for returns.

As we previously discussed, the US currency broke below the long-standing $100 support and is now testing it from below. If the mentioned line turns into resistance, it might result in a reversal to the downside and a continuation of the general downtrend.

BTC, ETH

Both BTC and ETH are still trading above their 21-EMAs on the weekly chart.

BTC is out of the daily range, but with the potential to make another higher low on the weekly chart. It is without saying that the lower volumes, the fact the market erased almost all gains from the XRP ruling rally and once again failed to surpass the $31.500 resistance brings more negative vibes to the short-to-midterm outlook for the market.

ETH, on the other side, was very much on its way to push its price above the upper boundary of the Ascending Triangle figure, but suffered another rejection as the trading range gets narrower and close to a point break. In general, the ETH fundamentals and its technical setup against BTC favors it over the biggest cryptocurrency in the midterm at least.