Britains Richest man Gopichand Hinduja accepts Brexit was not good for the country

Key Points Britains richest man Gopichand Hinduja has come out to accept that Brexit was a disastrous decision for the U.K. and has driven the economy down. The Indian-born investor believes that PM Rishi Sunak can resuscitate the economy and lift pain from the...

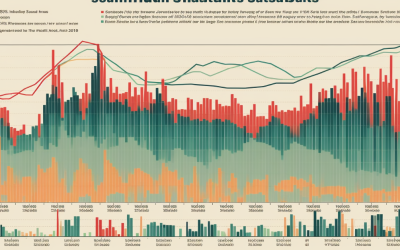

U.K. borrowing costs take a sharp dive following lower-than-expected inflation report

Key Points The two-year U.K. government bonds yield has fallen by 24 basis points to 4.843% following a drop in the country’s inflation rates. An August rates hike by 50 basis points now seems increasingly unlikely. U.K. borrowing costs have fallen sharply owing to a...

China reports flat CPI YoY and PPI fall by 5.4% in June

China has been one of the strongest economies in the world in the ongoing financial crisis, and it still sends relatively strong economic data. Its CPI remained flat in June, but the PPI has fallen to the lowest levels since 2016.

Hong Kong’s largest bank HSBC to offer Bitcoin and Ethereum ETFs to customers

Hong Kong spearheads crypto adoption in Asia as banks increasingly support the crypto industry. HSBC has now announced that it will offer customers Bitcoin and Ethereum ETFs.

Eurozone businesses start slowing in June owing to interest rate hike effects

Eurozone businesses are caught in a tight zone once more as high-interest rates haunt the economy. It is only expected to worsen from here, at least on a short to mid-term basis, as more hikes must be done to tame rising inflation. This means more pain will be felt in the markets even after the eurozone’s flash composite PMI dropped to 50.3 in June.

The US Federal Reserve lied about banking system stability-Balaji Srinivasan

The US Federal Reserve is under fire again for lying about the general outlook of the US banking system to ‘assure’ investors and citizens that there are no risks. However, the data that is coming forward isn’t all merry. Observers have noticed that the authority is spending more money than previously projected to bail out financial institutions.

More pain as Turkey Central Bank raises rates to 15%

On Thursday, the Central Bank of Turkey delivered another large interest rate hike to battle the overshadowing inflation rise. The move signals a shift towards more conventional economic policies to counter the sky-high inflation rates following the criticism that Tayyip Erdogan had led to higher living costs.

More pain as Eurozone stocks fall ahead of BoE rate hike decision

Eurozone has received news on the necessity for further rate hikes in a sour way making the stocks plummet as they await today’s decision from BoE. The Benchmark Stoxx 600 was down 0.92% at the open Thursday markets, with all sectors trading in the red.

Central Banks differ in taming inflation and dealing with recession fears

Central Banks worldwide have showcased commitment to dealing with wild inflation and evading possible reversed GDP growth. These efforts are necessary as costs of living are increasing in the short term, and if no action gets taken, they could go wild in the future, crippling the basic functioning of the economies in question.

Britcoin launch inches closer as Rosalind CBDC tests prove successful

Brits are set to receive Britcoin, a Central Bank Controlled Digital Currency (CBDC), as the Bank of England gets wowed by the potential of digital currencies. Following a successful trial study called Project Rosalind, BoE is more confident than ever in the functionality of Britcoin.

Digital dollar could trigger a bank run: Treasury Official

A digital dollar is still not sitting well with treasury Official Graham Steele on worries that it could very well trigger bank runs. Steele thinks that the in-research digital dollar could encourage further withdrawals from banks, weakening an already shaken system.

China reverses policy rate as post-Covid recovery slows down

China is in for an easier time as the People’s Bank of China (PBOC) reverses key monetary policies. The bank cut a key short-term policy following disappointing data from the economy after the nation failed to rise as expected following the Covid-19 reopening.