Table of Contents

TL-DL

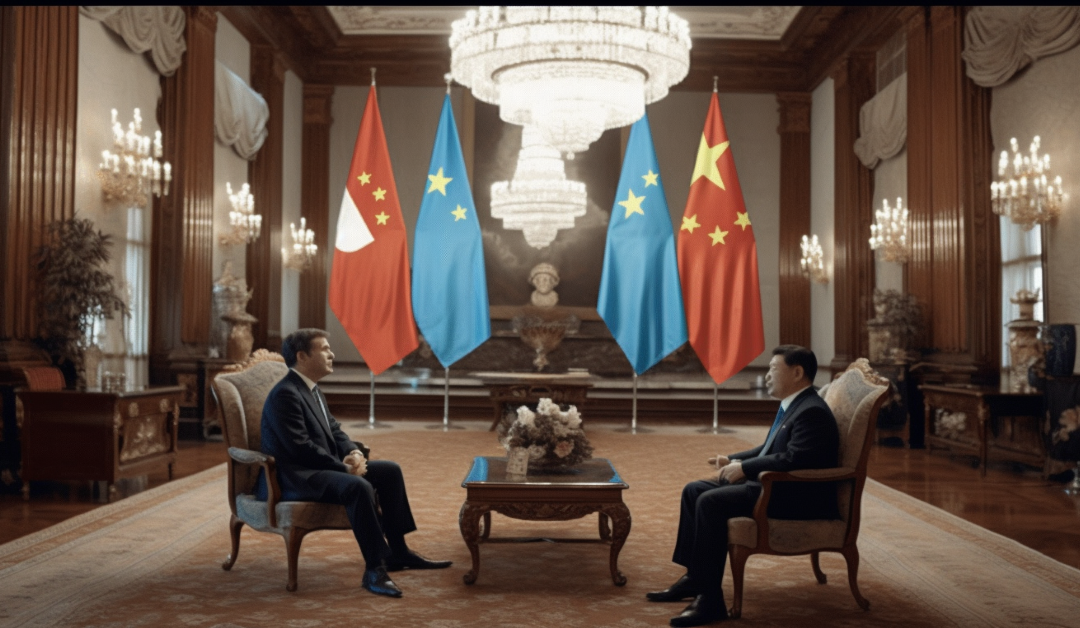

Argentina, one of the countries struggling with the highest inflation rates currently, is planning to expand its plans to de-couple from the U.S. dollar. The Minister of Economy, Sergio Massa, will enter into talks with China to expand the current swap line from $5 billion to $10 billion lent in Chinese Yuan.

BRICS gets a boost as more countries seek to stay away from the U.S. dollar

BRICS nations keep getting more support from second and third-tier countries as they push to de-couple from the struggling and ‘normally’ weaponized U.S. Dollar. Recently, China and Russia revealed plans to expedite the in-development international transaction system that will use a BRICS digital common currency to help them trade with other nations without using the U.S. dollar.

In other news, 25 more countries are actively seeking to join them as the U.S. dollar remains in a crisis of the country’s own making; now, Argentina wants to increase its alliance with China and reduce its dependence on the U.S. dollar. The Argentinian Economy Minister will travel to China on May 29 on a mission to double the free amount of money available in the swap line taking it to $10B.

China had allowed the nation to access $5B freely, which almost $2B has already been used in May and April, leaving it with lower reserves while the credit line amounts to almost $19B. Massa will seek to lead the two countries into an agreement on “political terms,” which is set to see the credit line expanded.

Argentina’s U.S. dollar reserves dropping as IMF charges harder

Argentina faces a significant decrease in its foreign currency reserves recording levels last seen last seven years ago. The dollar-denominated reserves in the country are down to $36B in May, which keeps getting worse as the country faces an inflation rate of 108%.

Argentina has been forced to impose hard measures to cut the rate at which the dollars flow from the local economy. It is also seeking to renegotiate terms with the International Monetary Fund to hasten the disbursements of the institution, which is set to be received between June and December.

However, the country’s Vice President Cristina Kirchner is calling to ditch the repayment deal, risking future disbursements from the fund. In a rally, she said that if the country doesn’t figure out how to get its financial independence and do away with the loans that come with conditions and controls from international funds, it will cripple the nation even more, making them unable to repay the debts.

Her comments come when reports about IMF imposing conditions that take away financial freedom from the Latin-America nation are surfacing. There have been reports that the IMF wants the country to ban the use of digital currencies, among other demands to receive their support.